Key Highlights

- Understanding capital gains tax in real estate is important homeowners and investors.

- The 121 home sale exclusion allows homeowners to exclude a portion of the capital gains from the sale of their primary residence.

- The 103 like-kind exchange allows investors to defer when they reinvest proceeds from the sale of investment property into another property.

- There specific rules and eligibility criteria both the 121 sale exclusion and the 1031 like-kind exchange.

- Utilizing strategies can help homeowners and investors save on their tax bills and continue to wealth through real estate- It’s important to consult with tax professional to ensure with the IRS regulations for capital gains tax.

Introduction

Real estate transactions can lead to significant capital gains tax implications for property owners. Understanding how to defer capital gains tax on real estate is crucial to minimize your tax bill effectively. By exploring various tax deferral strategies and leveraging special real estate conditions, you can navigate complex sales scenarios and capitalize on tax-deferred opportunities. This guide will provide valuable insights into managing capital gains tax in the realm of real estate investments.

Understanding Capital Gains Tax in Real Estate

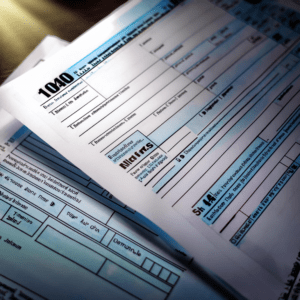

Capital gains tax in real estate is a levy imposed on the profit made from selling property. It applies to real property like homes or land. Understanding how capital gains are calculated is crucial for property owners. It considers the difference between the selling price and the property’s basis value. The tax rate on capital gains can vary based on factors like income and the period of ownership. Being aware of these aspects helps individuals navigate real estate transactions more effectively.

What Constitutes Capital Gains in Real Estate?

Capital gains in real estate are profits from the sale of property. They result from the difference between the purchase price and the selling price. Various factors like improvements made to the property during ownership can impact the amount of capital gains incurred.

How is Capital Gains Tax Calculated on Property Sales?

Capital gains tax on property sales is calculated by subtracting the property’s purchase price and expenses from the selling price. The resulting profit is subject to capital gains tax based on the holding period and tax rate. Understanding these calculations is crucial for effective real estate investment strategies.

Flow chart Example:

Purchase Price (Basis): $200,000

Strategies to Defer Capital Gains Tax On Real Estate

Utilizing the 1031 Exchange for investment properties and leveraging the Primary Residence Exclusion are effective strategies to defer capital gains tax on real estate. The 1031 Exchange allows for reinvestment of sales proceeds into a new property without triggering immediate taxation. Meanwhile, the Primary Residence Exclusion enables homeowners to exclude up to $250,000 (or $500,000 for married couples) of capital gains from their tax bill when selling their primary residence. Both methods offer tax deferral benefits while complying with IRS regulations.

Utilizing the 1031 Exchange for Investment Properties

Utilizing the 1031 exchange for investment properties allows real estate investors to defer capital gains tax by reinvesting proceeds from a property sale into a new property. This tax-deferral strategy, as per IRC Section 1031, facilitates the exchange of like-kind properties, enabling investors to defer paying taxes on the gains. By following exchange rules with a qualified intermediary, investors can reinvest and defer their tax bill, thus enhancing cash flow for future investments.

Example of a Successful 1031 Exchange

*In 2021, John Doe sold his rental property for a profit of $500,000. By using a 1031 exchange and reinvesting in a new rental property valued at $700,000, he deferred paying capital gains tax on his profit.*

[Learn more about 1031 Exchange rules from the IRS](https://www.irs.gov/)

The Role of Primary Residence Exclusion

Primary residence exclusion plays a vital role in deferring capital gains tax on real estate. When selling your primary residence, certain exclusions can apply, allowing you to exclude a portion of the gain from your taxable income. Understanding and utilizing these exclusions can help reduce your tax bill significantly. This exclusion is a valuable strategy for homeowners looking to minimize their tax liabilities when selling their main home. It is essential to consult with a tax professional to navigate the intricacies of this exclusion.

Key Points:

– Exclusion limit: $250,000 for single filers; $500,000 for married couples

– Must have lived in the house for at least 2 out of the last 5 years

[Important guidelines on Primary Residence Exclusion](https://www.irs.gov/taxtopics/tc701)

Leveraging Special Real Estate Conditions

Selling Your Home After a Spouse’s Death and navigating the implications of claiming a home office deduction are unique scenarios that can impact capital gains tax obligations. Understanding how these special conditions influence your tax bill is crucial when dealing with real estate sales. By recognizing the tax consequences and potential benefits tied to such situations, homeowners can strategically manage their capital gains taxes within the legal framework provided by the IRS.

Selling Your Home After a Spouse’s Death

After the passing of a spouse, selling your home might have tax implications related to capital gains. The tax consequences can vary based on the date of the sale and the status of the property. Understanding the rules concerning the basis, deferral, and exclusion is crucial in this scenario. Consulting with a tax professional or CPA can provide valuable insights into navigating this significant life event and its associated tax considerations.

Impact of Stepped-up Basis

A stepped-up basis can significantly reduce the taxable amount when you sell the inherited property.

Implications of Claiming a Home Office Deduction

Claiming a home office deduction can have significant implications on capital gains tax. It may impact the calculation of depreciation, affecting the property’s basis and potential tax deferral strategies. The IRS has specific rules regarding home office deductions, so it is crucial to ensure compliance to avoid any tax consequences. Understanding how this deduction influences your tax bill is essential for real estate investors looking to maximize tax incentives and minimize their overall tax liability. Compliance with the IRC section is key to utilizing this deduction effectively.

[Home Office Deduction Guidelines](https://www.irs.gov/taxtopics/tc509)

Navigating Complex Sales Scenarios

Handling Capital Gains from a Short Sale involves understanding the tax implications of selling a property for less than the outstanding mortgage balance. Dealing with Property Destruction and Insurance Claims requires navigating the tax consequences of receiving insurance proceeds after property damage. These complex scenarios necessitate careful consideration of IRS regulations to effectively manage capital gains tax liabilities and potential deductions.

Handling Capital Gains from a Short Sale

In a short sale scenario, handling capital gains involves assessing the difference between the sale price and the adjusted basis, which includes any outstanding debt forgiven. Capital gains are then calculated based on this amount and taxed according to the applicable tax rate. It’s crucial to consider tax consequences and possible deferral strategies like installment sales or utilizing a 1031 exchange to minimize your tax bill. Consulting with a tax professional or CPA can provide valuable insights into optimizing your tax situation in short sale transactions.

Dealing with Property Destruction and Insurance Claims

When faced with property destruction, understanding how insurance claims affect capital gains is crucial. Losses from property damage can impact your tax bill significantly. It’s essential to navigate the tax consequences of insurance payouts on real property. Consulting with a CPA or tax professional is advisable to ensure proper handling of these situations. By knowing how to manage insurance claims post-property destruction, you can mitigate potential tax implications effectively.

Tax-Deferred and Tax-Free Opportunities

Investing in Opportunity Zones provides opportunities to defer taxes. Understanding the impact of estate planning on capital gains can offer tax-free options. By leveraging these strategies, real estate investors can minimize their tax bill and maximize returns. Utilizing the benefits of tax incentives and specialized exchange rules can lead to substantial savings. Exploring qualified opportunity funds and tax-deferred investments can optimize tax consequences, ultimately benefiting from favorable tax rates in real estate transactions.

Investing in Opportunity Zones to Defer Taxes

Investing in Opportunity Zones is another strategy for deferring capital gains tax on real estate. Opportunity Zones are designated areas identified as economically distressed by the federal government. By investing in these zones, you can benefit from tax incentives aimed at promoting economic growth.

Key Points:

– Invest in Qualified Opportunity Funds (QOFs)

– Hold investment for at least 5, 7, or 10 years for increasing tax benefits

– Defer capital gains until the earlier of December 31, 2026, or when the QOF interest is disposed

Example

Jane Smith invested her capital gains in a QOF in 2020. By holding the investment for 10 years, she can potentially eliminate the capital gains tax on the QOF investment.*

[IRS Opportunity Zones FAQ](https://www.irs.gov/credits-deductions/opportunity-zones-frequently-asked-questions)

Understanding the Impact of Estate Planning on Capital Gains

Understanding the Impact of Estate Planning on Capital Gains

Estate planning plays a crucial role in minimizing the impact of capital gains tax on real estate for heirs. When a property is passed down to heirs, they inherit the property with a stepped-up basis, which is the fair market value of the property at the time of the original owner’s death. This stepped-up basis can significantly reduce the capital gains tax liability for heirs when they eventually sell the property.

By incorporating estate planning strategies, such as establishing a trust or gifting the property before death, property owners can help minimize the capital gains tax burden on their heirs. These strategies allow for the transfer of the property with a stepped-up basis while also providing potential tax benefits for the property owner during their lifetime.

Working with an estate planning attorney or tax professional can help property owners navigate the complexities of estate planning and develop a strategy that best suits their needs and goals. By taking proactive steps to minimize the impact of capital gains tax through estate planning, property owners can ensure a smoother transition of their real estate assets to their heirs.

Key Considerations for Rental and Vacation Properties

Key Considerations for Rental and Vacation Properties

When calculating capital gains on rental properties, several factors come into play. The gain or loss when you sell a rental property is generally characterized as a capital gain or loss. If the property was held for more than one year, it’s considered a long-term capital gain or loss. If held for one year or less, it’s considered a short-term capital gain or loss.

To calculate the capital gain on a rental property, subtract your tax basis in the property from the amount realized on the sale. The tax basis is typically the original cost of the property plus any additions or improvements, minus any depreciation taken. The resulting gain will be taxed at the applicable capital gains tax rates, depending on your income level.

Depreciation can have a significant impact on the capital gains calculation for rental properties. When you take depreciation deductions on a rental property, you must recapture that depreciation as ordinary income when you sell the property. This recaptured depreciation is taxed at a maximum rate of 25%.

Example

*If you purchased a rental property for $200,000, and over the years, you claimed $50,000 in depreciation, your adjusted basis when sold would be $150,000. If you sold the property for $250,000, your gain would be $100,000, with $50,000 subject to recapture.*

[IRS Depreciation Recapture Rules](https://www.irs.gov/publications/p527)

Understanding the specific tax rules for rental and vacation properties is essential for minimizing tax liability and maximizing the financial benefits of these real estate investments.

Calculating Capital Gains on Rental Properties

Selling a vacation home can have capital gains tax implications. Gains from the sale of vacation homes do not qualify for the same exclusion as primary residences. When selling a vacation home, the gain will be subject to the normal capital gains tax rates, depending on your income level.

To calculate the capital gain on the sale of a vacation home, subtract your tax basis in the property from the amount realized on the sale. The tax basis is typically the original cost of the property plus any additions or improvements. The resulting gain will be taxed at the applicable capital gains tax rates.

If you convert a vacation home to your primary residence, live there for at least two years, and then sell it, you may qualify for the full capital gains tax exclusion. However, if you do not meet the requirements for the exclusion, it’s important to be aware of the capital gains tax implications when selling a vacation home.

[Capital Gains Tax Exclusions for Vacation Homes](https://www.irs.gov/taxtopics/tc701)

Capital Gains Tax Implications for Selling Vacation Homes

Capital Gains Tax Implications for Selling Vacation Homes

Selling a vacation home can have capital gains tax implications. Gains from the sale of vacation homes do not qualify for the same exclusion as primary residences. When selling a vacation home, the gain will be subject to the normal capital gains tax rates, depending on your income level.

To calculate the capital gain on the sale of a vacation home, subtract your tax basis in the property from the amount realized on the sale. The tax basis is typically the original cost of the property plus any additions or improvements. The resulting gain will be taxed at the applicable capital gains tax rates.

If you convert a vacation home to your primary residence, live there for at least two years, and then sell it, you may qualify for the full capital gains tax exclusion. However, if you do not meet the requirements for the exclusion, it’s important to be aware of the capital gains tax implications when selling a vacation home.

Advanced Tax Strategies for Real Estate Professionals

Advanced Tax Strategies for Real Estate Professionals

Real estate professionals can take advantage of advanced tax strategies to minimize their tax liability and maximize their financial benefits. One such strategy is the reverse 1031 exchange, which allows real estate professionals to defer capital gains tax when exchanging real estate investment properties.

A reverse 1031 exchange is similar to a regular 1031 exchange, but it involves acquiring a replacement property before selling the relinquished property. This strategy can be beneficial when real estate professionals want to take advantage of a hot real estate market or secure a specific property before it becomes unavailable.

Another tax strategy for real estate professionals is focusing on depreciable property and recapture. Depreciable property refers to assets that have a limited useful life and can be depreciated over time. When real estate professionals sell depreciable property, they may be subject to recapture, where previously deducted depreciation must be included as ordinary income.

Real estate professionals should work closely with tax professionals who specialize in real estate to ensure they are utilizing advanced tax strategies effectively and minimizing their tax liability.

How to Use a Reverse 1031 Exchange

A reverse 1031 exchange can be a powerful tax strategy for real estate professionals. Here’s how it works:

– **Identify a qualified intermediary:** To initiate a reverse 1031 exchange, real estate professionals must work with a qualified intermediary who will facilitate the exchange.

– **Acquire a replacement property:** Real estate professionals can acquire a replacement property before selling the relinquished property in a reverse 1031 exchange. This allows them to secure a specific property or take advantage of a favorable market.

– **Sell the relinquished property:** Once the replacement property is acquired, real estate professionals must sell the relinquished property within 180 days.

– **Complete the exchange:** The qualified intermediary will facilitate the exchange, ensuring that all requirements are met and the transaction is compliant with IRS regulations.

By utilizing a reverse 1031 exchange, real estate professionals can defer capital gains tax and have more flexibility in acquiring and selling investment properties. Working with a qualified intermediary is essential to ensure a successful reverse 1031 exchange.

[Detailed Guide on Reverse 1031 Exchange](https://www.irs.gov/taxtopics/tc414)

Strategies for Depreciable Property and Recapture

Strategies for Depreciable Property and Recapture

Depreciable property and recapture can have significant tax consequences for real estate professionals. Here are some strategies to consider:

- Plan for recapture: Real estate professionals should be aware of the potential recapture of previously deducted depreciation when selling depreciable property. By planning for recapture, they can determine the tax consequences and potentially mitigate the impact on their tax liability.

- Utilize cost segregation studies: Cost segregation studies can help real estate professionals identify assets within a property that can be depreciated on an accelerated schedule. By properly allocating costs to different assets, they can maximize the depreciation deductions and potentially reduce recapture.

- Consider using like-kind exchanges: Like-kind exchanges, such as the 1031 exchange, can help real estate professionals defer taxes when exchanging one investment property for another. By deferring taxes, they can preserve their cash flow and potentially avoid or delay recapture.

Real estate professionals should work closely with tax professionals who specialize in real estate to develop strategies for depreciable property and recapture. By considering these strategies, they can minimize their tax liability and maximize their financial benefits.

Conclusion

In conclusion, navigating the complexities of deferring capital gains tax in real estate requires a deep understanding of various strategies and opportunities available to investors. Whether through utilizing 1031 exchanges, leveraging primary residence exclusions, or exploring advanced tax strategies, it’s crucial to make informed decisions to maximize tax benefits. By staying informed on the implications of different scenarios and considering tax-deferred or tax-free opportunities, real estate professionals can effectively manage their tax liabilities. If you need personalized guidance on managing capital gains tax in real estate, don’t hesitate to get in touch with our experts for tailored advice.

Frequently Asked Questions

What Are Common Misconceptions About Capital Gains Tax?

Common misconceptions about capital gains tax include the belief that it applies to all types of property sales, that it is a flat rate, and that it is the same as ordinary income tax. In reality, capital gains tax applies to the sale of certain types of assets, the rate depends on income level, and it is separate from ordinary income tax.

Can I Avoid Capital Gains Tax by Reinvesting in Real Estate?

Yes, by utilizing strategies such as the 1031 like-kind exchange or investing in Opportunity Zones, real estate investors can defer or avoid paying capital gains tax when reinvesting in real estate. These strategies provide tax incentives for reinvesting in specific types of real estate.

How Does a 1031 Exchange Work and What are the Deadlines?

A 1031 exchange allows real estate investors to defer capital gains tax by exchanging one investment property for another. The deadlines for a 1031 exchange are 45 days to identify the replacement property and 180 days to close on the replacement property.

What Are the Implications of Moving Into a 1031 Swap Residence?

Moving into a property acquired through a 1031 exchange can have implications for the capital gains tax exclusion. The portion of the gain that is taxed is based on the ratio of the time the property was used as a second residence or rented out to the total time the seller owned the property.