Key Highlights

Understanding Distressed Properties: Distressed properties are homes at risk of being taken back by banks or lenders. This usually happens because the owner has missed mortgage payments.

- Challenges for Homeowners: Homeowners of these properties often feel financial and emotional pain. They deal with complicated legal issues too.

- EPS House Solutions: We provide easy and fast help for homeowners who want to sell their distressed properties. Our goal is to give them peace of mind during tough times.

- Custom-Tailored Services: At EPS House, we know that every homeowner’s situation is different. That’s why we offer services that are tailored to fit their specific needs.

- Success Stories: We have assisted many homeowners in getting through foreclosure. We turn unwanted properties into new chances.

Introduction

In today’s changing real estate and housing market, distressed properties can create both problems and opportunities for homeowners and investors. It’s important to know the issues related to distressed properties. You should also understand why some homes become distressed. This knowledge can help you make smart choices about different types of homes. This blog post will provide useful information and solutions for homeowners facing distressed properties. It will also explain how EPS House can assist in managing this difficult situation.

Understanding Distressed Properties

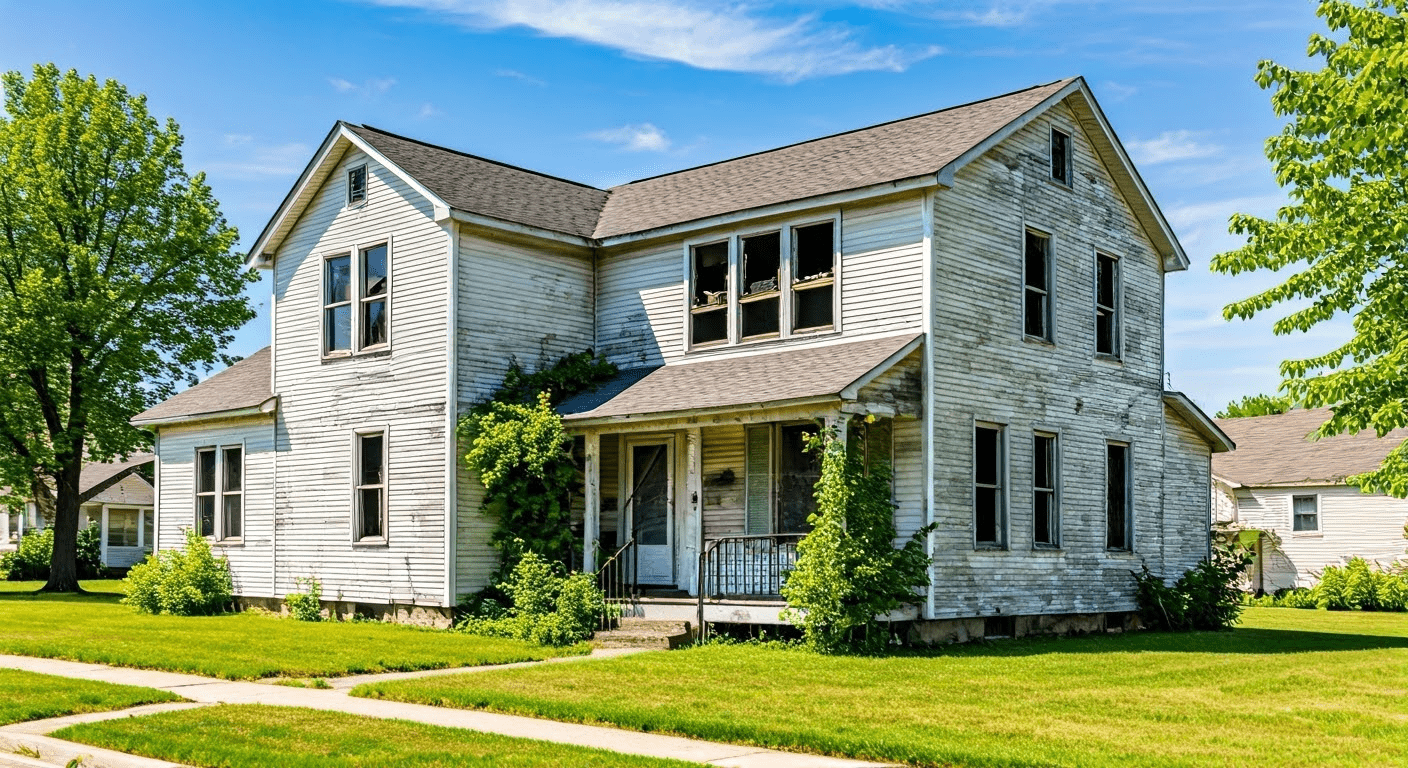

Distressed properties are homes that face money issues. There are several reasons for this. A common reason owners miss their mortgage payments is because the home needs significant repairs. The property may also be in poor condition. In simple terms, a distressed property is worth less than what is owed on it.

Many factors can make a property distressed, but mortgage problems are the most common. Homeowners might lose their jobs, have health issues, or face other sudden challenges that make it hard to pay their mortgages. If they don’t take care of the property, it can decline in condition and value, making things even tougher.

Identifying Signs of Distress in the Real Estate Market

To spot distressed properties in the real estate market, you need to watch for specific signs. A key sign is delinquent mortgage payments. This issue can result in a default notice. A default notice is a public record, and you can usually find it online on several county websites.

Another warning sign is bad property upkeep. A troubled property might have overgrown lawns, need major repairs, or have boarded windows. These problems often show that the owner is struggling to maintain the house because of money issues.

Checking public records can help you learn about troubled properties. You can look for things like foreclosure notices, county court records, unpaid taxes, and auction news. Many websites make it easy for you to see these records. This way, you can spot possible opportunities or problems more easily.

Types of Distressed Properties: Foreclosures, Short Sales, and REOs

Navigating distressed real estate means understanding the different types. Each type has its own opportunities and problems.

- Foreclosures: This happens when people can’t pay their mortgage. Lenders start foreclosure to get their money back. These homes usually sell for a lower price at public auctions. This attracts investors looking for a good deal.

- Short Sales: In this case, the current owner sells the home for less than what they owe on the mortgage, but must get the lender’s permission first. This process helps avoid foreclosure and gives buyers a chance to get a lower price than the market value.

- REOs (Real Estate Owned): After a foreclosure, if homes don’t sell at auctions, they become REOs which means the bank owns them. Banks want to sell these homes quickly. This makes REOs a good choice for buying distressed properties at possibly nice prices.

Knowing the details about each type of distressed property is important for buyers. This information affects the buying process, legal issues, and any risks that may occur.

The Challenges Homeowners Face with Distressed Properties

Owning a distressed property is not only about money issues. It can also bring emotional struggles for the homeowner. This situation might cause high stress and anxiety levels. The worry of losing a home, especially during hard times, might affect mental and emotional well-being.

Going through legal steps, like foreclosure or short sales, makes things harder. You have to talk to lenders and lawyers. You also need to manage a lot of paperwork. This only makes the stress worse.

Financial Burdens and Emotional Stress

The first problem with having a distressed property is financial distress. Homeowners who can’t make their mortgage payments may end up with legal fees and growing debts. This can lead to serious issues for them and create emotional stress that harms their health.

Homeowners often fear losing their homes. They worry about the future. This worry can lead to feelings of shame, anxiety, and hopelessness. Managing these feelings along with money problems needs strong determination and support from others.

It is good to get help during tough times. Financial advisors and mental health experts can provide support and tools. They can assist homeowners in coping with both emotional and money-related stress.

Navigating Legal and Tax Implications

Distressed properties can lead to money trouble. They also have many legal and tax problems. It’s good to understand these issues so you don’t face more problems later. For instance, if you don’t pay property taxes, this could result in tax delinquencies. This might mean big fines or even losing your property.

When you sell a distressed property, taxes may come into play. The selling price can affect if you need to pay capital gains tax. This can add more stress to homeowners. It is smart to seek help from tax experts or real estate lawyers. They can assist with these tricky legal and financial issues.

It is important to understand the laws in your state regarding foreclosures, short sales, and redemption periods. Being aware and taking action can help homeowners create a better list of homes and choices for their distressed property.

How EPS House Helps Homeowners with Distressed Properties

At EPS House, we know dealing with distressed properties can be hard and stressful. We are here to help homeowners find simple solutions. This allows them to move forward in their lives without the added worry of their difficult property.

Our helpful team is ready to support you at every step. We promise to keep things simple and make the process easy. We aim to offer fair cash deals for distressed properties. This takes away the stress of repairs, long listings, and the uncertainties of regular real estate transactions.

Providing Hassle-Free, Fast Solutions

For homeowners looking to sell easily, we buy distressed properties for cash. This makes us a dependable cash home buyer. There are no bank loans or appraisals to worry about. You can close the sale quickly, which is usually difficult with normal home sales.

A cash offer gives homeowners peace of mind. They feel safe that their sale is secure. There are no usual worries or delays when selling a home. This is important because there can be problems at the last minute. We understand that time is really important in these situations. That’s why we work hard to make the selling process quick and clear.

Our simple process makes selling a troubled property less stressful. From our first meeting to receiving a fair cash offer, our team will stay connected and offer help. We change what might feel like a big challenge into something easier.

Custom-Tailored Services for Every Homeowner

At EPS House, we understand that every troubled property has its own unique challenges. We aim to provide personal service and helpful solutions for each homeowner. We spend time understanding your situation, goals, and finances. This way, we can make the best solution just for you.

Our experienced team is ready to help you at every step of the way. We want to make sure you understand each part and can make good choices. If you are facing foreclosure, too much repair work, or need to sell your home quickly and fairly, we aim to reduce your stress and clarify things during difficult times.

At EPS House, you are not just another transaction. We focus on building strong relationships based on honesty and care. We truly understand your needs. Our main goal is to help you move towards a better future. We want to free you from the stress of a difficult property.

The Process of Selling Your Distressed Property to EPS House

Selling your difficult property to EPS House is simple and fast. You can begin by making a quick phone call. You can also fill out an online form. Just share important details about your property.

Our team will look at your property and review the details you provided. After that, we will quickly give you a fair cash offer with no conditions attached. We aim to be clear and honest. This way, you will understand the process and feel good about what will happen next.

Initial Consultation and Property Evaluation

During your first meeting, our team will spend time getting to know your situation. We will answer any questions you have about the selling process. We believe that open talks help build trust. This way of communicating makes everything easier.

After the meeting, we will conduct a complete evaluation of your property. This helps us determine the value of your property by looking at similar properties. We will consider several factors, like the location of your property, its condition, any needed repairs, and the current market trends.

You can trust us. We take time to evaluate your property fairly. This way, you get a cash offer that shows its real value, even if it needs repairs. We believe in being honest and straightforward during the whole process.

Receiving a Fair Cash Offer

We have carefully looked at your property and today’s market value. Because of that, we are making you a fair cash offer for your distressed property. Unlike typical real estate deals where people negotiate, our offer reflects our true opinion on what your property is worth.

We understand that it is important for homeowners to get a fair price, especially when they are having money problems. Our goal is to make sure the deal is clear and fair. We don’t want you to feel like you are getting a bad offer or being taken advantage of when you are in tough times.

We want to make sure everyone wins. Our cash offer might be lower than the asking price you wanted in an ideal market. However, it reflects the current condition of the property. This offer helps avoid the risks of traditional sales and quickly solves your distressed property issue.

Closing the Deal Quickly and Efficiently

Once you agree to our cash offer, we will finish the deal fast and simply. Our team handles all the paperwork. We team up with title companies to ensure the closing process goes smoothly. We understand that delays can cause stress during difficult times. So, we work hard to be quick while still taking care of all important details.

Our closing process is faster than other real estate sales. This means homeowners can continue with their lives with less waiting. It also gives them peace of mind. We will take care of each step honestly and professionally. Our goal is to make sure our clients have a good experience.

We want to make selling your problematic property easy and stress-free from start to finish. We keep our communication clear. We are here to help with any worries you have. We work hard to ensure a successful closing on time.

Success Stories: Homeowners We’ve Helped

Throughout our time in real estate, we have met many home buyers facing tough financial issues. They struggle with money problems and risk losing their homes. We use our skills to assist homeowners in selling their distressed properties. It makes us happy to see their relief as we help them through the selling process. We also work with cash buyers to ensure all transactions go smoothly. These experiences show our commitment to helping those in difficult situations. We aim to provide people with peace of mind during these hard times.

Overcoming Foreclosure and Financial Hardship

One of the best things about our job is helping homeowners who are facing foreclosure. Our cash-buying method helps those who are about to lose their homes. This way, they can prevent a lot of money trouble and emotional stress.

We have helped many families face job loss, health problems, and other surprises that put their homes at risk. By buying their distressed properties at a fair price, we provide them the money and peace of mind they need to begin anew. Their stories of strength and hope show how we care about making a good impact on people’s lives.

With our easy process and care, we have helped many homeowners avoid the long-term issues of foreclosure. Their success stories make us believe that everyone deserves a chance to get through tough times and build a safe future.

Transforming Unwanted Properties into Opportunities

We think that unwanted properties can turn into good chances in the real estate market. When we buy homes that need help, we fix them up and sell them again. This helps create value for future homeowners.

This method helps our business grow. It also supports the health of the communities we belong to. We promise to use fair and ethical practices. We want our work to have a good impact on people and the environment.

We enjoy uncovering the hidden potential in every property. Our goal is to change it into a home where families can thrive. We focus on long-term value. This way, we aim to be a positive force in the real estate market.

Conclusion

Navigating distressed properties can be very hard. But with the right help, homeowners can find support. It’s important to understand the signs of distress and know what types of properties are affected. These problems include money issues and legal troubles, which can be quite complicated. EPS House provides custom solutions for these challenges. They make transactions quick and simple. Their success stories show how they helped homeowners avoid foreclosure and turn unwanted properties into new opportunities. If you are facing a distressed property issue, reach out to EPS House for support. With their skills and personal touch, you can handle this tough time with confidence.

Frequently Asked Questions

What Makes a Property ‘Distressed’?

Distressed properties usually happen because homeowners face money problems. These issues often lead to the property needing significant repairs or being in poor condition.

How Fast Can EPS House Close a Deal on a Distressed Property?

EPS House offers fast closing options for property sales that need assistance. We use a cash offer model. Our smart approach helps us complete deals much faster than regular real estate sales.

What are the challenges faced by distressed home buyers?

Distressed home buyers face challenges like financial instability, limited housing options, potential property damage, and emotional stress. Navigating legal complexities and time constraints further add to their difficulties in finding suitable housing solutions during challenging times.